Launch Your Prop Firm in Just 2 Days

Turnkey solutions for Proprietary Trading Firms. Xtreme Next delivers advanced technology for trader evaluation, account funding, and performance tracking. Built around precision, reliability, and innovation — our platform offers low-latency execution, high scalability, and robust trading analytics. Xtreme Next brings together expert minds in trading technology to empower prop firms to grow, manage risk, and scale globally with ease.

Forex Broker

Tick by Tick 100+ Major and Minors and Exotic Pairs

CFDs Broker

Tick by Tick, Low Latency, Level2 Books

Global indices & US Stocks

Multi-Asset Liquidity for Global indices & US Stocks

World class Trading Platforms

Super-fast flagship trading platform with elegant UI, streaming market data, advanced charts

Trade from Python, Trading view using our free API

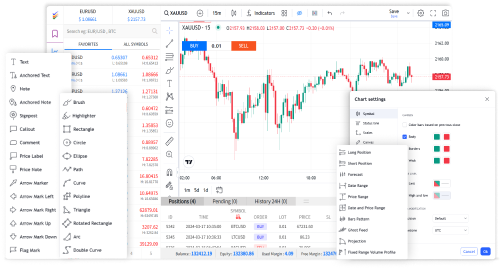

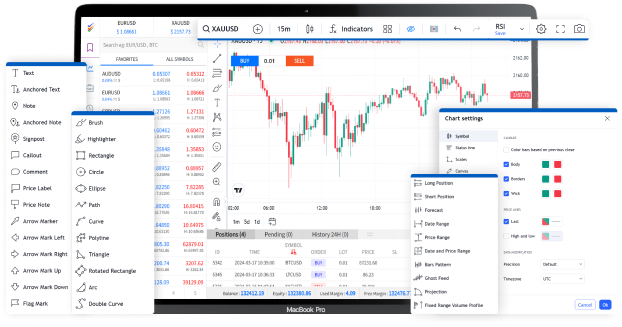

Advanced Charts

Hundreds of indicators, studies, and tools on a powerful and customisable charting interface. Extensive historical data for forex, stocks and metals from 20+ exchanges. Nobody else offers as much data as we do.

Sleek User Interface

With a sleek and carefully designed UI, buying, selling, analysing, and managing your portfolio, everything's just

a click away.

Easy to Customize

Components

User Friendly

interface

We can help you !

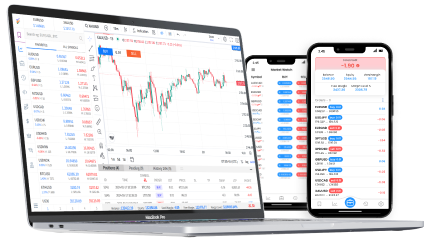

Super-fast elegant UI

Super-fast flagship trading platform with elegant UI, Inbuild strategies, streaming market data, advanced charts. Experience the way of trading.

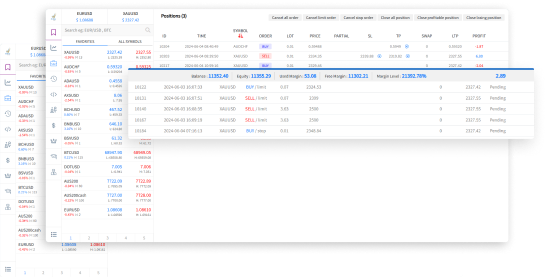

Integrated position management

Manage positions in single window, manage Live open positions and open pending orders. Hundreds of indicators, studies, and tools on a powerful and customisable charting interface.

We can help you !

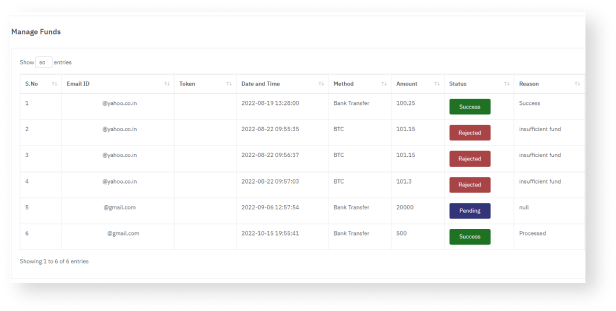

Free advanced CRM Built for performance

An effective CRM is the lifeblood of any retail brokerage. XTCRM was crafted to make staying in touch with your Forex traders easy. Benefits of XTCRM: Smart Dashboards, Control Access, Performance Tracking etc...

Liquidity Bridge Solutions

We can offer brokers several options of obtaining liquidity. Each of the options has its pros and cons, and they all depend on the requirements and possibilities of a given broker. High-quality liquidity is only half the success of the company. Any broker needs to not only provide their clients with a high-quality stream of quotes but also to hedge their orders without losses in speed and quality of execution, which is often a demanding task. Global Market Multi-Asset Liquidity & Trading Technology solutions provider for Brokerages and Institutions.

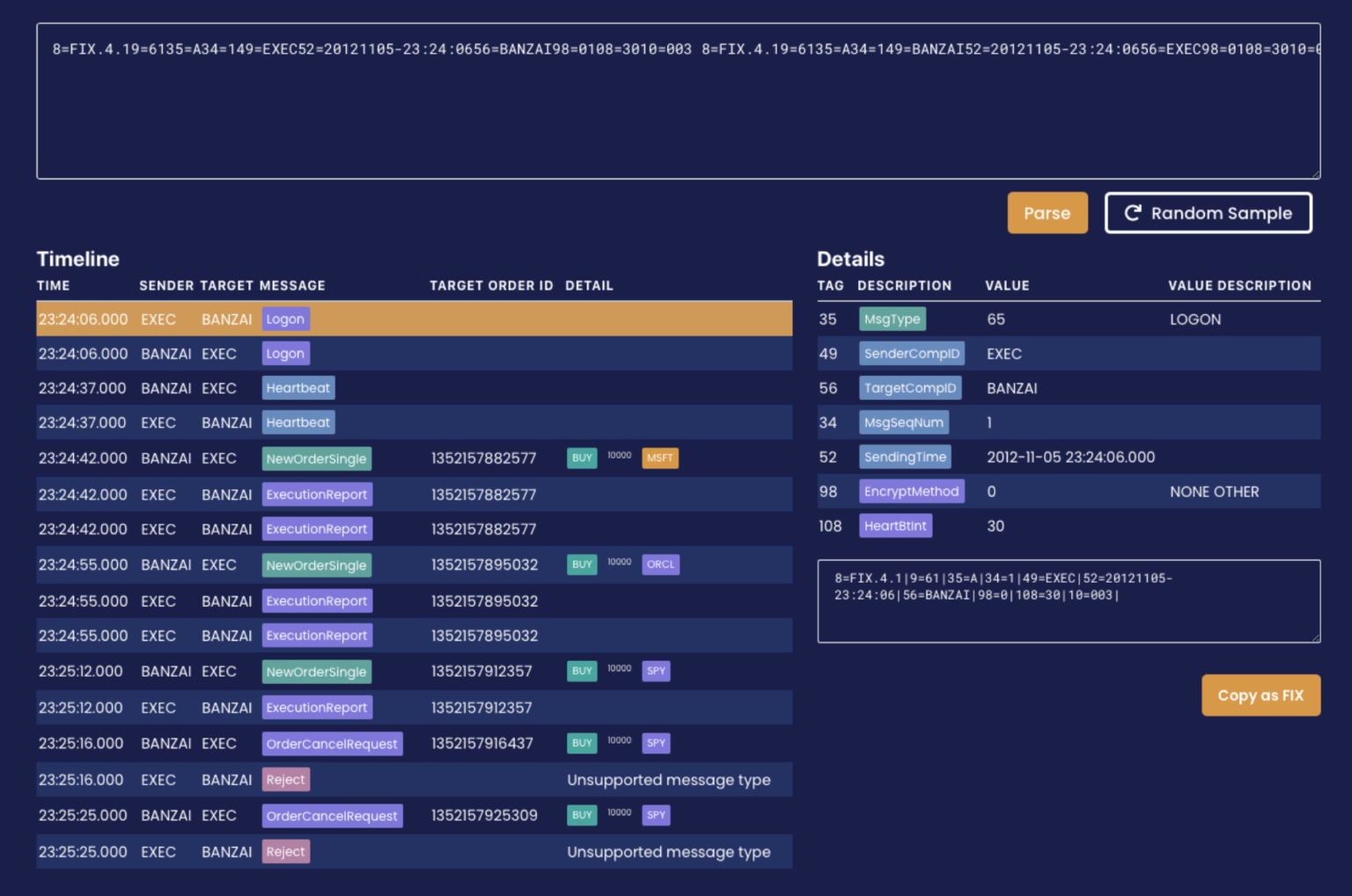

FIX API

FIX API Trading is ideal for institutional, professional and high-frequency retail traders, as it works to further increase their trading capabilities.

The FIX API provides a fixed, inextensible array of transaction types that system developers must abide by, all geared towards two main categories of exchange:

1. Real-Time Market Data

2. Order Execution & Management

3. Industry standard trading protocol

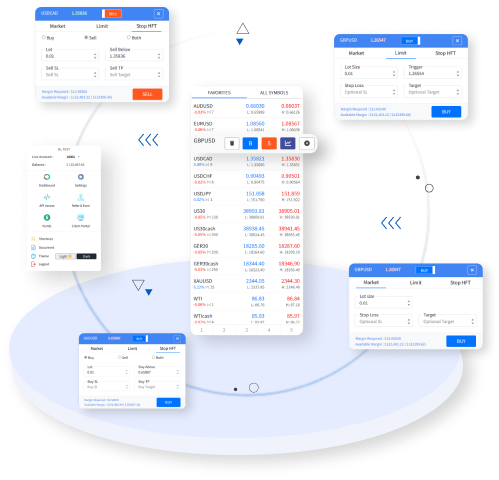

Mobile App

Trading really can be done effectively on a mobile device. There are two ways to trade:

1. One-click Trade

2. Order tickets

One-click Trade buttons allow an immediate market order to be sent upon a single click of a button, for fast decision-making. One-click Trade uses traders preset preferences.

Order tickets, on the other hand, allow traders to submit market, limit, stop and stop limit orders, where order size, protection levels and settings can be applied from an easy-to-use order form.