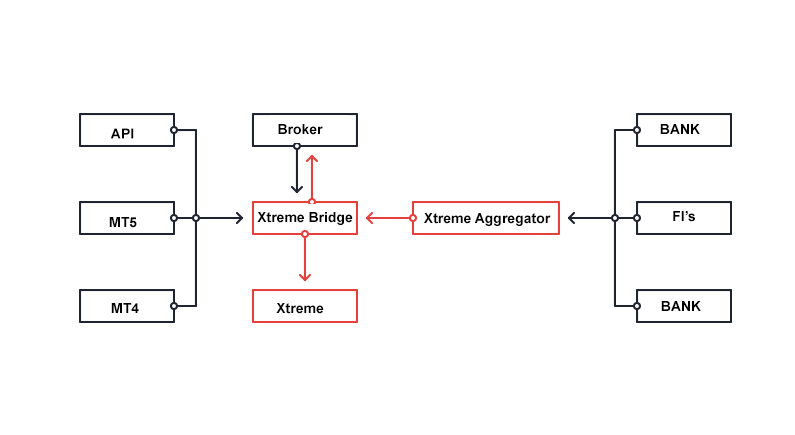

The benefits of FIX API bridge

. The bridge includes a service for individual trade setup through which customers can configure the orders according to their preferences. Our bridge is fast, stable and flexible, allowing for detailed configuration of different parameters of hedging and overall performance. The bridge does not require a separate server, it can be easily run in parallel with other types of accounts and handle a limited number of groups. The bridge connects directly to ECN and can operate either as a separate provider or with any number of providers connected to the aggregator.

Reliability and stability

The bridge works in large companies where trade volumes are measured in tens of billions

High speed execution of large volumes of data

Advanced functionality for traders (trade setup is already integrated into the bridge);

Flexible hedging system

Partial hedge of customers, customer groups, or individual instrumentS

Delivering efficient market structure

Our team has over 10 years’ worth of experience working with the liquidity providers. We have overseen the integration of dozens of banks and brokers, and collected a huge statistics on the quality and flow of execution.

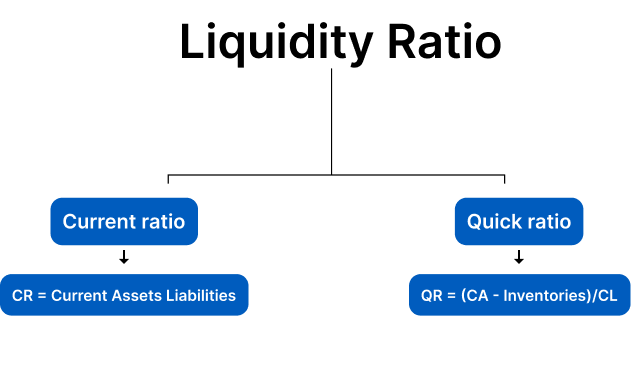

Our liquidity

The liquidity offered by us is ideal since this is a high-quality stream with narrow spreads and well-balanced performance. Its collection is being overseen by our main partner, a European regulated broker. This option includes a sufficient number of quality liquidity providers, and its effectiveness is both time-tested as well as proven by multi-billion dollar turnovers. A single liquidity provider has several major advantages: No need to deposit funds to each provider and move them between providers in hopes of adjusting imbalances;

A single provider

This liquidity has the advantages of a single liquidity provider listed in the previous section, but it also has a number of disadvantages: Unreliability of the stream can result in the problems of the provider immediately becoming the problems of the broker; It is often not a very dense and smooth stream; Normally, it does not have narrow spreads; The provider may widen the spreads and worsen execution without the possibility of intervention by the broker.

Several providers

This options works in the opposite way – the flow can be tight and even, and the spreads narrow, but there are problems dealing with multiple providers:

The need to deposit money to each provider;The need to monitor the distribution of open positions and prevent imbalances;

The need to have more funds for the margin;

Periodic need to transfer funds between providers.

Transparent, fair, consistent execution

Transparent, precise, consistent execution Xtreme Tech, delivers efficient market structure and transparent, precise, consistent execution to all market participants, including funds, banks, proprietary trading firms, brokerages and asset managers.

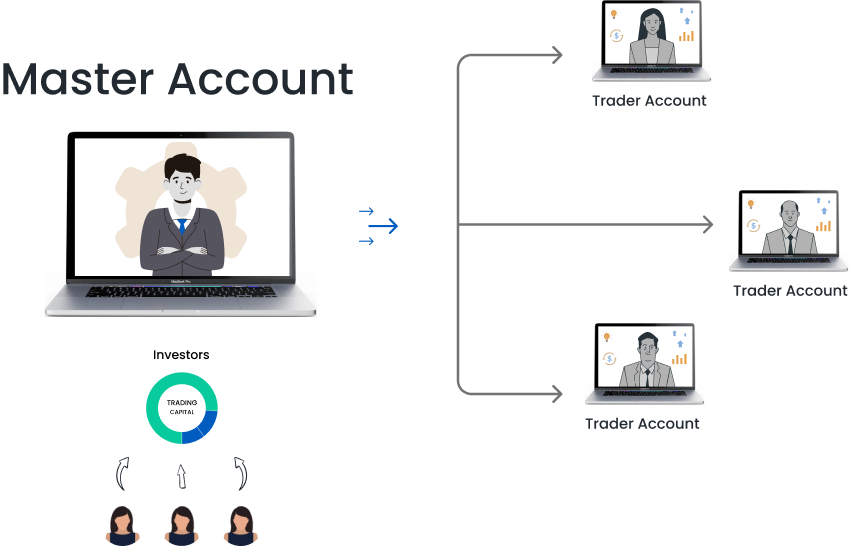

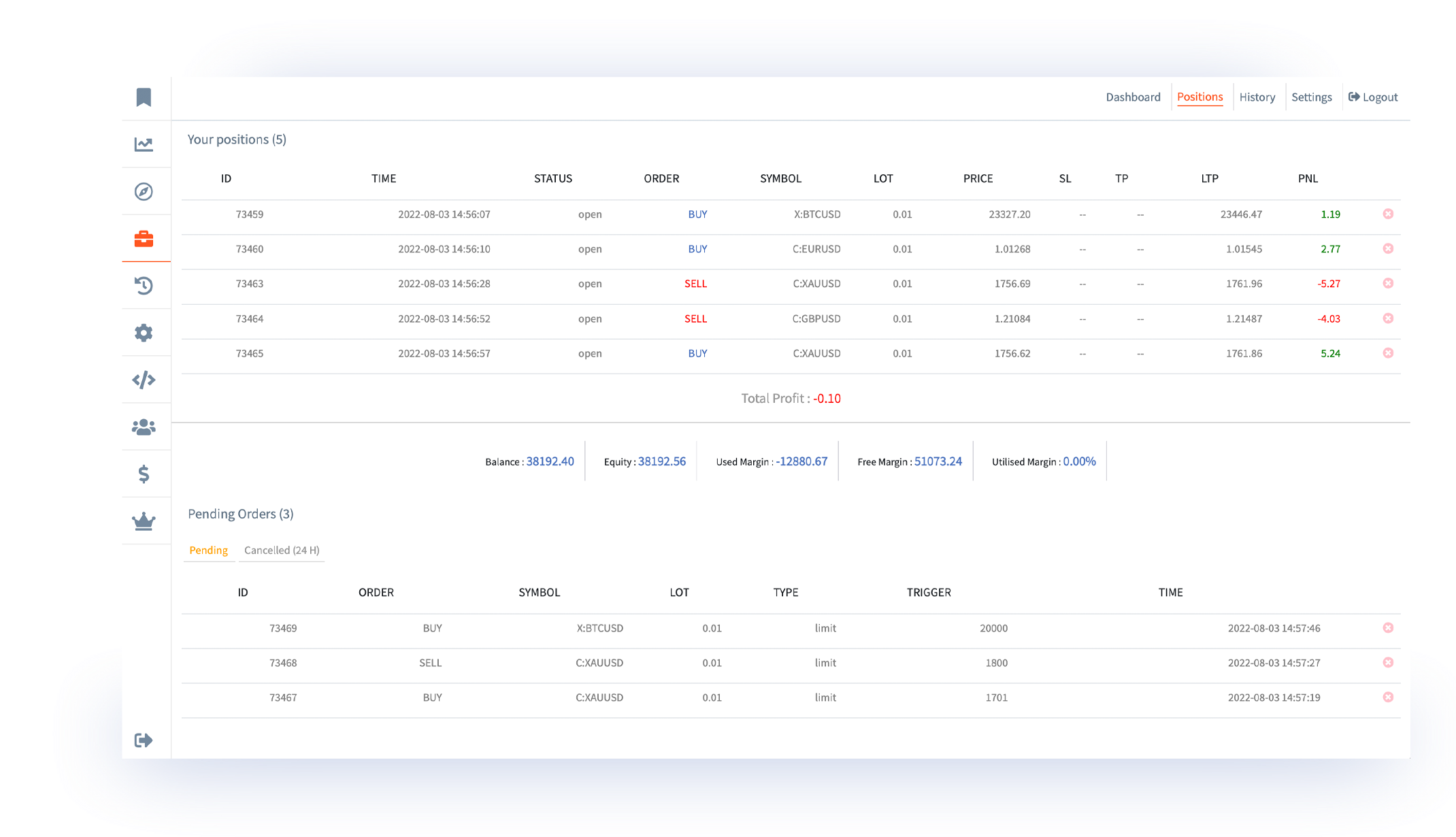

Copy Trading with MAM & PAMM

Xtreme Tech Invest is an innovative way you can access the opportunities of trading without any technical skills, and the minimum of time. You simply choose to copy traders (also known as Strategy Managers) who are right for you and make their trading strategies available to follow. We’ll do the rest! Copy trading with Xtreme Tech Invest lets you retain full control of your money, and you’ll only pay a fee to your Strategy Manager when they make a profitable trade.