Institutional Liquidity Solutions

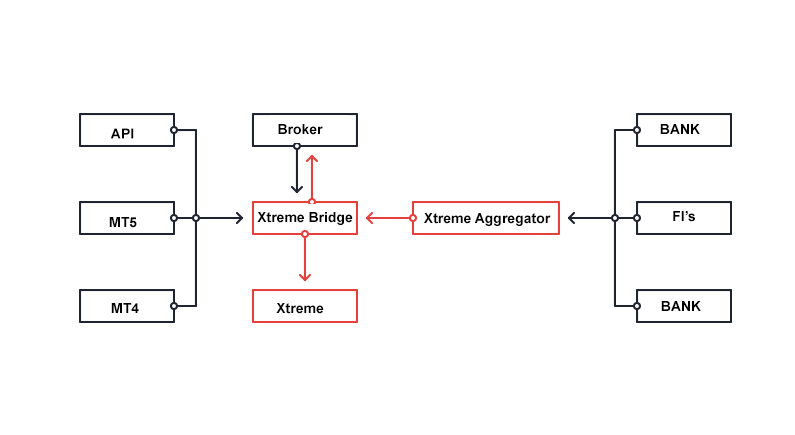

We can offer brokers several options of obtaining liquidity. Each of the options has its pros and cons, and they all depend on the requirements and possibilities of a given broker. High-quality liquidity is only half the success of the company. Any broker needs to not only provide their clients with a high-quality stream of quotes but also to hedge their orders without losses in speed and quality of execution, which is often a demanding task.

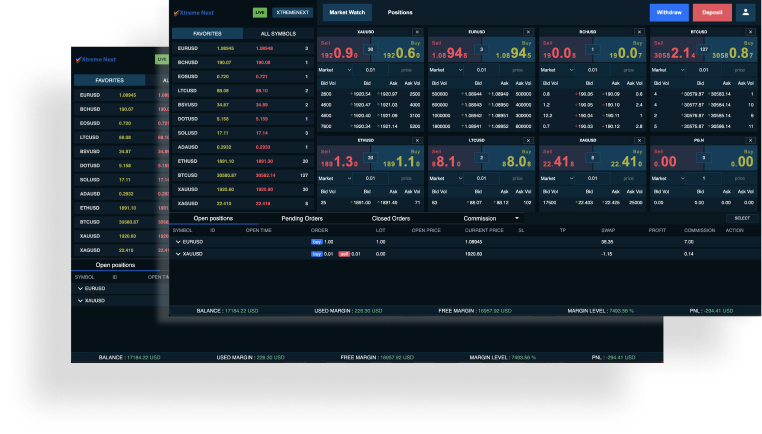

Forex Broker

Ultra-low latency order execution on 20ms*

Crypto Broker

Enhanced with worlds best trading platform

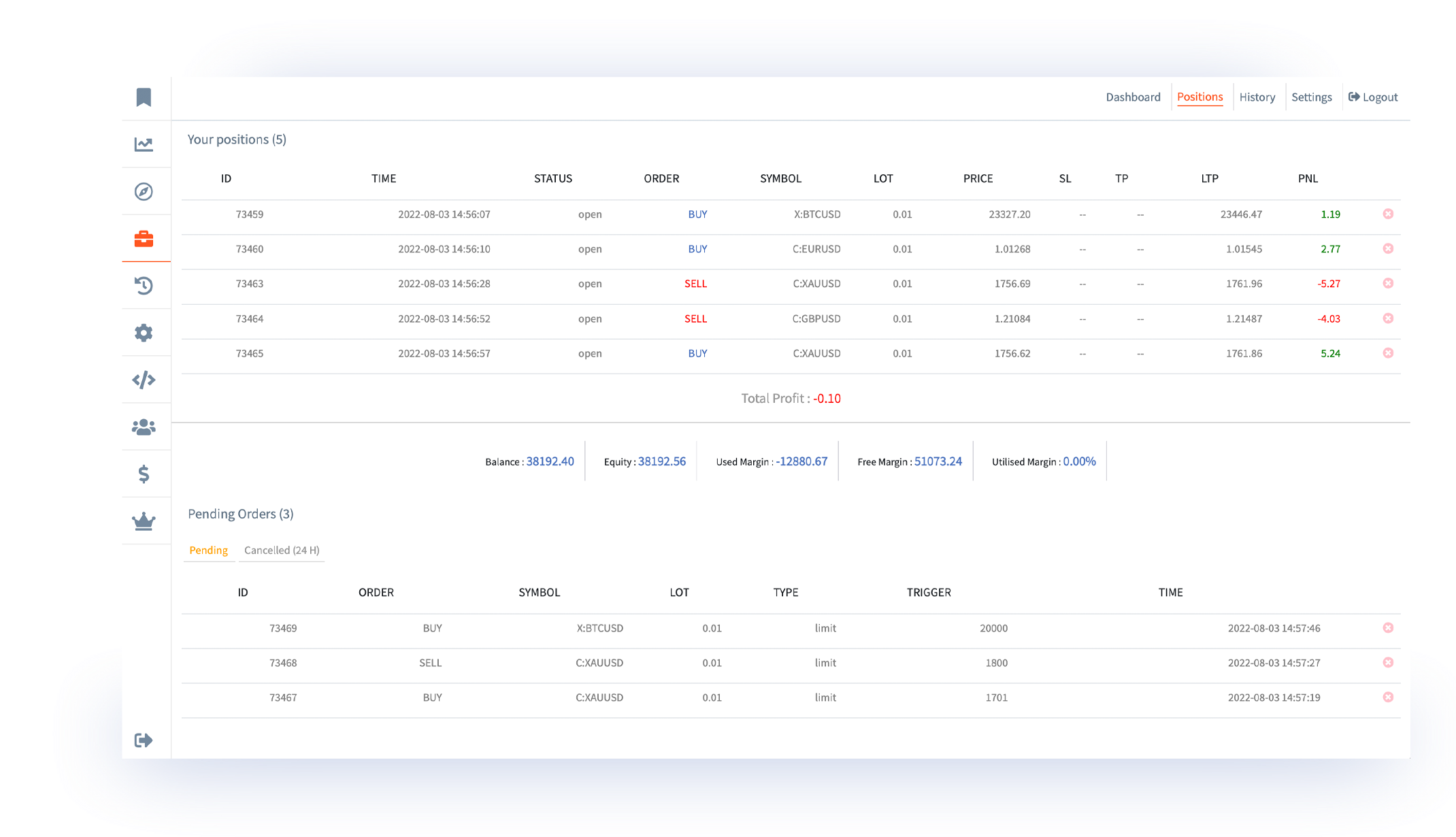

Copy Trading Platform

Index, Stocks, Futures, Options, MCX, Forex

Delivering efficient market structure

Our team has over 10 years’ worth of experience working with the liquidity providers. We have overseen the integration of dozens of banks and brokers, and collected a huge statistics on the quality and flow of execution.

Our liquidity

The liquidity offered by us is ideal since this is a high-quality stream with narrow spreads and well-balanced performance. Its collection is being overseen by our main partner, a European regulated broker. This option includes a sufficient number of quality liquidity providers, and its effectiveness is both time-tested as well as proven by multi-billion dollar turnovers.

A single liquidity provider has several major advantages:

No need to deposit funds to each provider and move them between providers in hopes of adjusting imbalances;

A single provider

This liquidity has the advantages of a single liquidity provider listed in the previous section, but it also has a number of disadvantages:

Unreliability of the stream can result in the problems of the provider immediately becoming the problems of the broker;

It is often not a very dense and smooth stream;

Normally, it does not have narrow spreads;

The provider may widen the spreads and worsen execution without the possibility of intervention by the broker.

Several providers

This options works in the opposite way – the flow can be tight and even, and the spreads narrow, but there are problems dealing with multiple providers:

The need to deposit money to each provider;The need to monitor the distribution of open positions and prevent imbalances;

The need to have more funds for the margin;

Periodic need to transfer funds between providers.

Transparent, fair, consistent execution

Transparent, precise, consistent execution Xtreme Tech, delivers efficient market structure and transparent, precise, consistent execution to all market participants, including funds, banks, proprietary trading firms, brokerages and asset managers.

Best support 24*7

Whether for on-site assistance, technical support, or remote support, Source is here to ensure our customers’ success and end-users’ business productivity. We offer dependable, on-demand support options including 24/7 technical and remote support.

Whatsapp support: +971 545856972

Email: [email protected]