Features of PAMM:

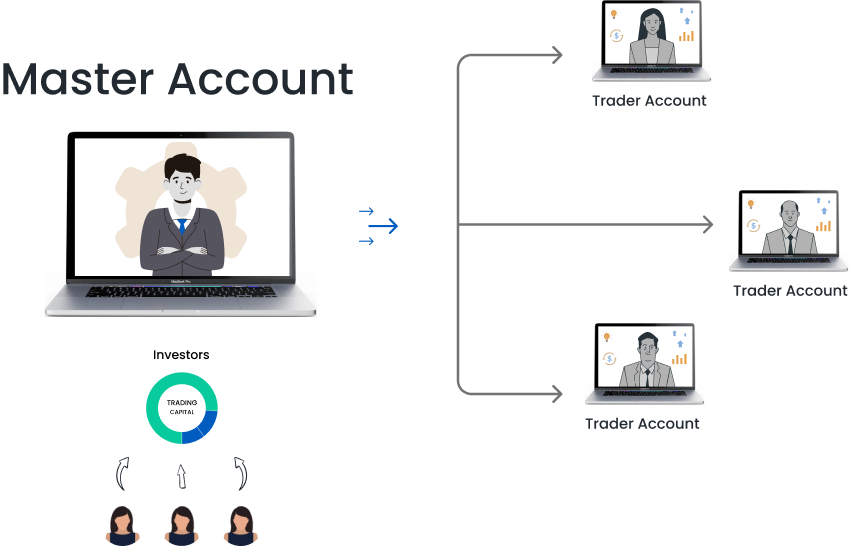

The PAMM account is a unique product that allows investors to earn without having to trade. You can invest your funds in the accounts of traders, who receive a percentage of the profits they earn from trading with your funds as a reward.

High Earning Potential

Experienced money managers trade via pooled money, which can increase the winning rate of the trades and subsequently the potential profit.

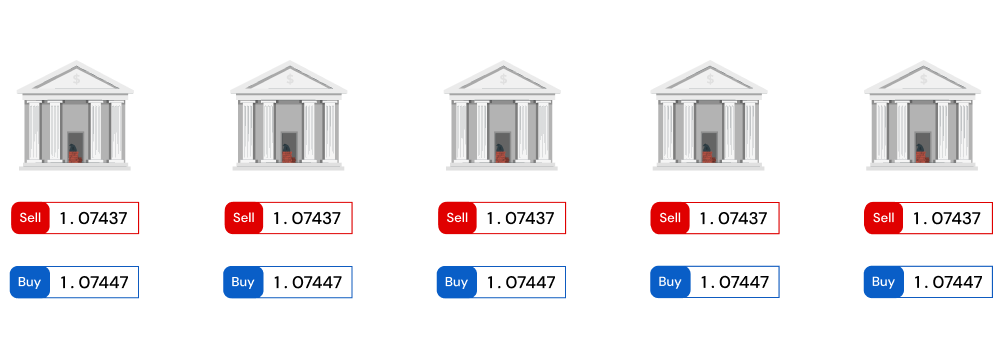

Quality Pricing and Execution

Tight spreads, low latency, and high click-through rates put you in the heart of the action for success.

Stable Technology

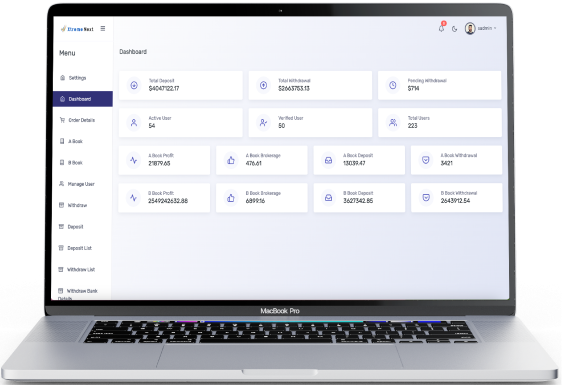

High-end technology to ensure optimal server uptime, stability, and user-friendliness.

Benefits for the manager:

Automatic correction of transactions’ volumes. When withdrawing and depositing, volumes of open orders and pending orders are automatically adjusted to the preferred value. Automatic correction can be adjusted by the manager.

Any trading strategy is permitted. The service does not limit trade tactics, it allows both long-term trading and scalping.

Trading investor funds exclusively. Manager may only trade investor money, without investing their own funds.

Benefits for the investor:

Individual trading interval. The investor can independently set the trading interval (frequency of profit sharing). Immediate withdrawal. The investor may at any time withdraw funds from an account in just 5 minutes regardless of any open positions of the manager or other factors. Flexible offer. Percent of compensation may depend on the amount and term of the investment.Benefits for the broker:

High reliability. Xtreme Tech PAMM system was created by a group of highly qualified developers with decades of combined experience in the Forex industry. Flexible and scalable architecture service. The service is not tied to the operating system or a terminal and does not have any architectural limit to the number of servers or users. Speed of deployment. Xtreme Tech PAMM system is ready and B2B solutions can be quickly deployed with any broker. Resistance to stress. The system has been tested with high loads and has good speed and resilience.

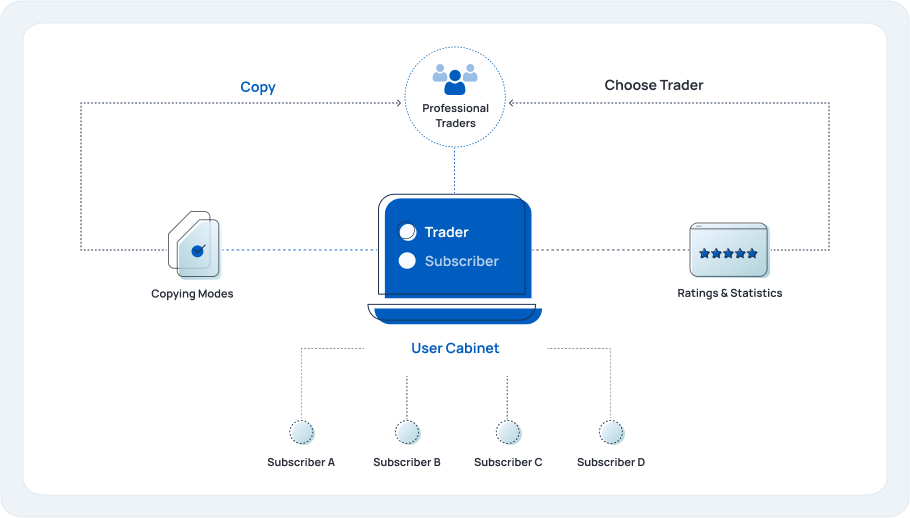

The Ultimate MAM platform

Attract the best traders and money managers with a feature-rich MAM platform.

MAM managers are the most valuable asset your brokerage can have as they always have their own pool of investors. Our platform can help you meet the needs and requirements of the most sophisticated money managers. Once they come to you, they will bring all their investors to your company!

UNIQUE OPTIONS THE BIGGEST CLIENTS

Separate web interfaces for IBs